Limited Liability Partnership (LLP)

Sage Final Accounts can help you prepare final accounts for limited liability partnerships (LLPs).

To prepare final accounts for LLPs, choose the ‘Limited Liability Partnership (LLP)’ Client type when creating a set of accounts.

Supported LLP types

Sage Final Accounts supports:

- Micro-entities preparing accounts in accordance with the micro-entities regime for LLPs and FRS 105.

- Micro-entities preparing dormant accounts in accordance with Section 1169 of the Companies Act 2006 (as applied to LLPs).

Sage Final Accounts doesn’t yet support:

- Small LLPs that aren’t applying the micro-entity provisions.

- Medium or large LLPs.

- Audited accounts.

- The Statement of Recommended Practice ‘Accounting by Limited Liability Partnerships’ (LLP SORP).

Guide to the LLP client type

Members and designated members

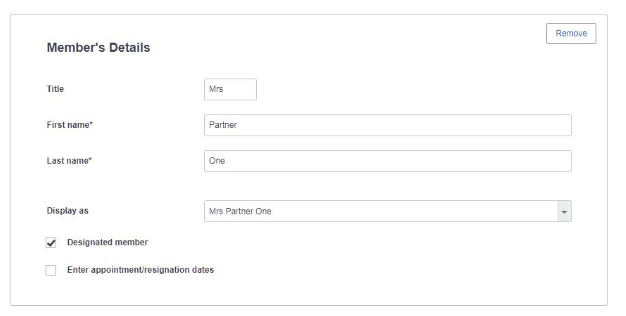

On creating a new set of accounts, the first member’s details will be automatically populated from the client details already created. As an LLP legally must have at least two members, you will need to continue to populate the details of the rest of the LLPs members as described in Enter officers and professional advisers.

Under LLP regulations, every LLP must have at least two formally appointed designated members at all times. You must indicate in Sage Final Accounts which of the members are designated by ticking the ‘designated member’ box below that member’s details.

Those assigned the designated member status will be included in the officers and professional advisors page of the accounts, and will be made available as signatories on the Statement of Financial Position.

LLP chart of accounts

The LLP chart of accounts is based on the limited company chart of accounts, with some differences in key compliance areas for LLPs.

The following chart codes are specific to LLPs:

| Code/Range of codes | Description | Use in accounts |

|---|---|---|

| 2244, 2644 | Liability for post retirement payments due to former members | Included within the creditors <1year and >1year balances |

| 2700 – 2704 | Provision for post retirement payments to former members | Included within the provisions for liabilities balance |

| 3000 – 3006 | Members’ loan accounts | Part of ‘Loans and other debts’ balance |

| 3100 – 3131 | Members’ current accounts | Part of ‘Loans and other debts’ balance. Any profit allocations or members’ remuneration should be included here |

| 3200 – 3210 | Members’ capital classed as a liability | Part of ‘Loans and other debts’ balance |

| 3250 – 3256 | Other loans and other debts accounts | Part of ‘Loans and other debts’ balance, can be used for any additional member accounts you may have recorded |

| 3300 – 3315 | Members’ capital | Part of ‘Members’ other interests’, the equity of theLLP |

| 3450 – 3475 | Other reserves | Part of ‘Members’ other interests’, the equity of theLLP. Profits available for discretionary division are included here if they are not allocated to members |

| 7025 | Pension costs in respect of former members | Income statement expense related to the liability |

| 8900 | Unwinding of discount in relation to retirement benefits to former members | Income statement expense related to the liability |

| 9100 | Members’ remuneration under an employment contract | Part of ‘Members’ remuneration charged as an expense’ |

| 9110 | Members’ remuneration arising from participation rights | Part of ‘Members’ remuneration charged as an expense’ |

| 9120 | Non-discretionary division of profits | Part of ‘Members’ remuneration charged as an expense’ |

Members’ remuneration and profit shares

In an LLP, members’ remuneration is separated from the other income statement items for disclosure purposes, with “profit before members’ remuneration and profit shares” being a statutory heading in the income statement. In final accounts, members’ remuneration charged as an expense, must be posted to codes 9100 to 9120, which are excluded from this profit subtotal.

Members’ remuneration is represented in three ways:

- Members’ remuneration under an employment contract (9100): Any remuneration paid to members under a contract to supply services (a contract of employment) should be posted here.

- Members’ remuneration arising from participation rights (9110): Payments arising from components of members’ participation rights in the profits for the year should be posted here.

- Non-discretionary division of profits (9120): Where the members’ agreement gives the members an unconditional right to all or part of the profits, this is considered an automatic division of profits and should be posted here.

This remuneration should be posted directly into the members’ current accounts.

The double entry for these postings in Sage Final Accounts is as follows:

- Dr: Members’ remuneration charged as an expense (9100 – 9120).

- Cr: Members’ current accounts – Remuneration charged as an expense (3103).

Discretionary division of profits

Any profit remaining after members’ remuneration is “Profit available for discretionary division among members”. This amount can only be allocated out following an approval by the members. There is not an unconditional right to receive the amount.

A discretionary division of profits should be debited directly to equity in the year in which the division occurs and should not be presented as an expense within profit or loss.

The double entry for this posting in Sage Final Accounts is as follows:

Dr: Other reserves – Discretionary division of profits to members (3454).

Cr: Members’ current accounts – Discretionary division of profits (3110).

The decision and the division may take place after the year end, once the final profit is known, in which case the profits should remain in other reserves at the year end and the above posting should be made as at the date of the division, in the following financial year.

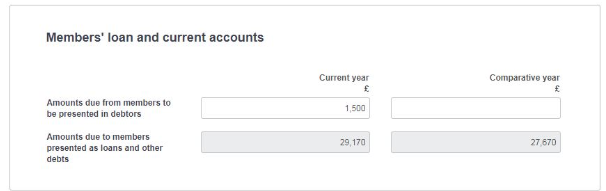

Amounts owing to and from members

Total members’ interests are made up of “Loans and other debts due to members” (debt) and “Members’ other interests” (equity).

Within loans and other debts due to members are the members’ loan accounts, members’ current accounts, capital classed as a liability and other similar accounts. These accounts are assumed to be debts of the LLP, however, debits on members’ balances cannot be offset and should be shown separately within debtors on the Statement of Financial Position (SOFP).

In Sage Final Accounts

Postings to members’ accounts (3000 – 3256) are automatically presented within loans and other debts due to members. If any of this balance needs to be presented within debtors, that amount should be entered on the Data tab, in section ‘Members’ loan and current accounts’.

The amount entered here will automatically be added to the overall debtors balance in the Statement of Financial Position and removed from the Loans and other debts due to members total, so that the SOFP still balances.

Final Accounts cannot automatically post this adjustment due to the potential complexities of the calculation and the data available.

Example 1 – discretionary division of profits:

- An LLP has 5 members, whom take monthly drawings of £5,000, totalling £60,000 for the year.

- The LLP has made £100,000 profit before members’ remuneration and profit shares for the financial year.

- There is no automatic division of profits or other remuneration paid and so the whole amount is available for discretionary division.

- The members’ decision to allocate all the profits to members takes place after the financial year end.

At the year end: the profit of £100,000 is retained in Other reserves and the balance on the members’ current accounts is an overall debit of £60,000, which must be presented as amounts owed by members, within debtors, if recoverable.

In the following financial year: when the profits are allocated, the allocation can be offset against the drawings and the overall credit of £40,000 would be disclosed within loans and other debts due to members.

Example 2 – automatic division of profits:

- An LLP has 5 members, whom take monthly drawings of £5,000, totalling £60,000 for the year.

- The LLP has made £100,000 profit before members’ remuneration and profit shares for the financial year.

- The members’ agreement states that 100% of profits are automatically divided equally between the members (non-discretionary profit share).

: an expense of £100,000 is debited to members’ remuneration charged as an expense in the income statement and credited to the members’ current accounts. The remaining profit available for discretionary division is nil and no amount is retained in Other reserves.

The balance on the members’ current accounts is an overall credit balance of £40,000, which is therefore owed to the members and remains disclosed as Loans and other debts due to members.

Individual balances

Note that the individual balances of each member should not be offset. If, in example 2 above, just one of the members had taken the £60,000 drawings. The profit allocation to this member would be £20,000, giving them an overall debit of £40,000 on their current account.

The total of all the members’ current accounts would be a credit of £40,000, but the amounts cannot be offset in the accounts. In this scenario, £40,000 must be presented as a debtor and £80,000 presented as a debt of the LLP within Loans and other debts due to members.